A Massive Rate Cut Injects Confidence into the Veins of Commerce

15 FEBRUARY 2026 : 10:49PM

Mozel Chimuka

Mozel Chimuka, AfricaWorks, AgoraVillage | 15 February 2026 — A stressed small business owner sits amidst piles of unpaid invoices and stalled expansion blueprints, staring at a loan application previously deemed impossible to service. He watches the breaking news ticker flash the rate cut and immediately grabs his calculator to punch in the new numbers, feeling the crushing weight of high interest evaporate as the math finally yields a profit margin that justifies breaking ground tomorrow.

The logic behind this renewed confidence is rooted in a hard-won victory over prices. With the "inflation dragon" retreating faster than forecasts predicted, the Bank of Zambia (BoZ) seized the moment during its February 2026 meeting. The decision to slash the Monetary Policy Rate (MPR) by 75 basis points to 13.5% marks a turning point, acknowledging that macroeconomic stability is now firm enough to support cheaper borrowing costs.

The Spectacular Collapse of Price Pressures

Inflation has retreated with speed and finality. Just months ago, in September 2025, the headline rate loomed at 12.3%. By December, it had cooled to 11.2%, before plunging into single digits—9.4%—in January 2026. A "pincer movement" of economic good fortune fuelled this rapid deceleration: a bumper maize harvest from the 2024/25 season crushed food prices, while a surging Kwacha made imports cheaper. With these forces in play, the Bank now projects will surrender completely, entering the 6% to 8% target band by the second quarter of this year.

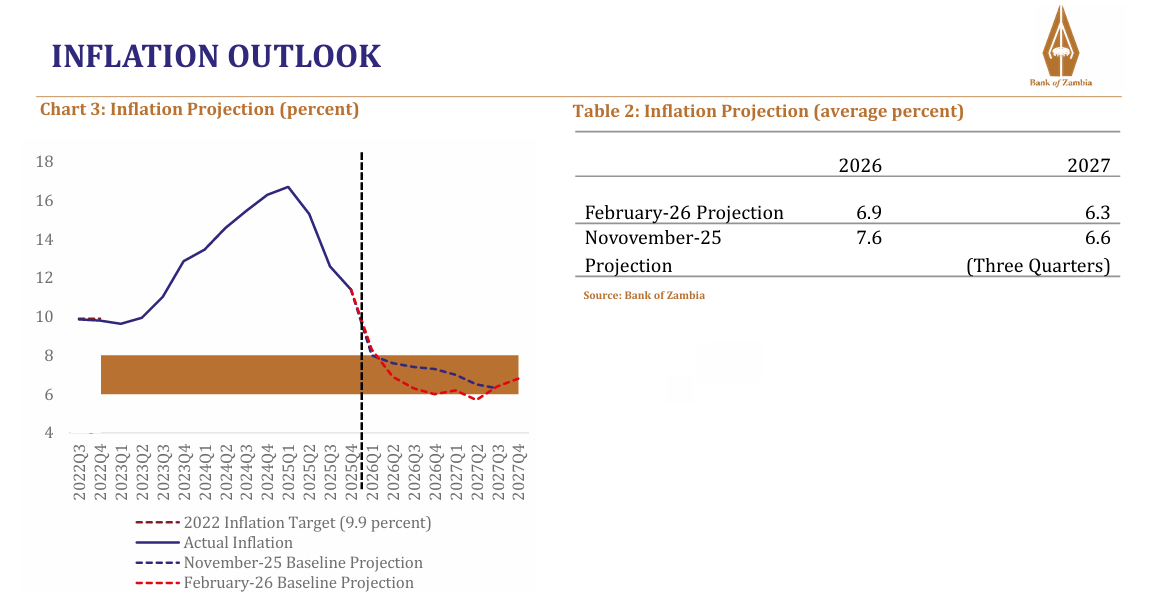

Dr. Denny Kalyalya, the Governor of the Bank of Zambia, signalled a palpable sense of relief regarding the trajectory of consumer prices. He observed that the speed of disinflation had outperformed even the central bank’s own sophisticated models. The drop to 9.4% in January 2026 inflation serves as a critical psychological milestone, driven fundamentally by supply-side improvements in agriculture and exchange rate pass-through effects. Consequently, the Monetary Policy Committee (MPC) revised its outlook downward, forecasting annual averages of 6.9% for 2026 and 6.3% for 2027.

source: Bank of Zambia. Govorner Media Presentation Q1 2026

Dr. Kalyalya further indicated that the risks to the inflation outlook are assessed to be tilted to the downside. Such an assessment suggests that favourable weather patterns and high copper prices could push inflation even lower than currently projected. The MPC statement highlighted that the 2024/25 farming season delivered a bumper maize harvest that has successfully insulated households from volatile food prices. Simultaneously, the appreciation of the local currency has reduced the cost of imported goods, creating a virtuous cycle that dragged overall inflation down significantly. With the price of essentials stabilising, the Bank of Zambia effectively has a clear runway to guide inflation into the lower bound of the target corridor by 2027.

Copper, Currency and the Strategic Vault

Underpinning this stability is the Kwacha, which has strengthened significantly against major convertibles. By the close of 2025, the local unit had appreciated by 4.1% in the fourth quarter alone, closing at ZMW22.80 per USD. Year-to-date, the currency has gained a solid 14.2%. Such appreciation is not accidental. It results from a confluence of positive market sentiments: a sovereign credit rating upgrade, a finalised Staff-Level Agreement with the International Monetary Fund (IMF), and, crucially, a bullish copper market.

Mining continues to function as the economy’s engine room. In the fourth quarter of 2025, the sector supplied USD759.4 million in foreign exchange, with over USD400 million sold directly to the market and USD344.6 million paid in taxes. This influx of forex, combined with the new Currency Directives issued in December 2025, has flushed the market with liquidity and bolstered confidence.

Beyond the immediate currency flows, the Bank of Zambia is quietly fortifying the nation's long-term financial security. Gross international reserves have climbed to USD5.5 billion, representing 4.8 months of import cover. This establishes a healthy buffer against external shocks. A key component of this reserve growth is the Bank’s strategic gold accumulation. Since late 2020, the BoZ has been purchasing locally produced gold to diversify its assets. In the final quarter of 2025 alone, the Bank purchased 175.23kg of gold worth USD23.5 million. The central bank now holds over 3,226.51kg of gold, with a market value approaching USD446.9 million. Accumulating these hard assets effectively creates a sovereign balance sheet that commands respect in international markets, moving the nation away from fragility toward a fortified financial position.

Balancing Growth with Emerging Pressures

Macroeconomic stability is beginning to filter down to the real economy. Both the Stanbic Bank Zambia Purchasing Managers Index (PMI) and internal BoZ surveys indicate improved business conditions. The narrative of growth is expanding beyond mining into ICT, tourism, and agriculture, supported by a notable stabilisation in electricity generation. However, the MPC statement was careful to present a balanced view, highlighting emerging pressure points that temper the jubilation.

While the economy grows, the current account deficit has widened to USD140.0 million, representing 2.0% of Gross Domestic Product (GDP). A surge in imports—specifically industrial machinery and petroleum—drove this shift. While a deficit usually raises eyebrows, the nature of these imports suggests an economy that is retooling and investing in capacity, rather than merely consuming. The widening deficit is less a sign of distress and more an indicator of an industrial sector gearing up for production.

Domestic credit growth simultaneously slowed to 14.4% in December 2025. Such a slowdown reflects a period of consolidation, with the private sector—particularly construction and agriculture—paying down debts, and the government clearing fuel arrears. Despite this credit cooling, foreign confidence remains high, with non-resident investors increasing their holdings of government securities by ZMW4.2 billion to a total of ZMW65.7 billion.

The February 2026 MPC decision stands as a definitive milestone. By cutting the rate to 13.5%, the Bank of Zambia has signalled that the emergency phase of fighting inflation is over. Focus now shifts to supporting growth within a stable price environment. With the inflation target in sight and the Kwacha holding its ground, Zambia appears to be entering a sweet spot of economic recovery. Providing the weather holds and copper prices remain strong, the trajectory for 2026 is one of cautious, yet distinct, optimism.

Featured Image

Category: Policy and Development